The Wall Street Titans: My grandfather chooses to sink or swim in the financial pyramid of the roaring 20s

James G. Hall will be mentored, purchase a seat on the NYSE and open a brokerage - all shortly before the crash of '29.

James G. Hall would begin a career as a stockbroker in the mid-1920s during the Great Bull Market on Wall Street in New York City. He already had business acumen as he had been professionally tutored by one of the premier financial industrialists, Howard Earle Coffin. My grandfather developed a close personal friendship with him along with other significant investors in pre-commercial air transport capitalization. Though plainly speaking, this would also be an unprecedented, “risk vs. reward” environment. There were few rules and no regulation. James G. Hall would be taking part in an historical moment of financial speculation – to either sink or swim.

James G. Hall was taking part in a historic period of capitalism: the greatest highly leveraged financial bubble in U.S. history. He would also witness first-hand the catastrophic results when the Wall Street stock market crashed on October 29, 1929, sending the U.S. economy and the world into the Great Depression. Known as “Black Tuesday” Wall Street investors traded some 16 million shares on the NYSE in a single day with billions of dollars lost. Thousands of investors were wiped out.

Putting this historical framework into perspective provides a snapshot of the fast-paced, winner-take-all financial environment my grandfather stepped into on Wall Street in the mid-1920s. As an apprenticeship was required, James G. Hall and any “young gun” seeking an opportunity at this epicenter of the financial world would have to join a brokerage firm and be mentored.

Around 1926-1927, James G. Hall would be hired by Samuel Ungerleider & Company at 50 Broadway, in New York City. The founder and owner, Samuel Ungerleider was engaged in the distilling business until Prohibition went into effect in 1920. That year he purchased a seat on the NYSE and founded Samuel Ungerleider & Company, which had its headquarters in Cleveland and branches in Ohio and Michigan. In 1926, the firm moved its head office to New York.

In that same year (1926), Ungerleider would also launch an investment trust with capital of $25 million, called the Ungerleider Financial Corporation with “potent names of William Fox, head of Fox Films, David Bernstein, treasurer of Loew’s Inc. (Fox Subsidiary), William Durant, motor and market man, and Louis S. Posner of Goldman Sachs Trading Corporation.”

A short personality sketch of Ungerleider from a 1929 business and finance section of Time magazine offers an insight into the profile of a self-made man, confident in his political and professional connections and associations:

“Short, stocky, genial, twinkly eyed, Mr. Ungerleider makes many friends. The walls of his offices are crowded with auto-graphed pictures of Congressmen, financiers, tycoons of one kind or another. A non-partisan in politics, he knows many a politician, spent much time on long distance telephone calls during both Kansas City and Houston nominating conventions. He does not however meet any of his friends on golf courses. Mr. Ungerleider never had a golf stick in his hand. And of this eccentricity he is extremely proud.”

Clearly my grandfather had joined a major brokerage and financial “player” in the booming “Bull Market” of the 1920s. Ungerleider had five stock exchange offices across New England and the Midwest. These were located in New York, Detroit, Cleveland, Pittsburgh, and Columbus, as well as a Board of Trade commodities seat on the burgeoning Chicago Mercantile Exchange. James G. Hall would certainly have been an attractive and competitive candidate for mentoring under Ungerleider. He was young, ambitious, and business-minded, already having proven his business acuity skills with financial operations and capital transaction experience, assisting in pioneering early airmail service development.

In addition, his resume also had significant professional associations and employment: A high level position at Curtiss Aeorplane as Assistant to the President and a financial and personal relationship with the legendary inventor, industrialist, and financier, Howard Earle Coffin. Ungerleider would clearly have recognized the evidence of my grandfather’s aptitude, exhibiting at a young age all the successful characteristics of an aspiring broker.

Conversely, my grandfather would have brought valuable business connections with him from his previous professional associations with Curtiss, Martin, and, of course, a personal association with Coffin. Specifically, Coffin had co-founded the 3rd largest of the original U.S. automobile companies, Hudson Motor Company, which made the “Essex” that competed directly with Ford’s “Model T.” The Hudson Motor Company share offerings would come to be represented and sold by Ungerleider. James G. Hall would certainly have had an intermediary role in developing this business transaction, as Coffin could have chosen any brokerage house on Wall Street to list his high-demand shares.

As a young broker under the mentorship of an established, expanding, and multi-stock exchange brokerage, my grandfather enjoyed the competitive advantage and financial opportunities that Ungerleider would certainly have provided. The scale of operations at Ungerleider naturally offered more branch management positions and openings, with advancement positions and promotion for aggressive and successful in-house brokers that brought profit and other ventures to Ungerleider. As an example of this type of promotion via expansion, and the extensive financial services offered, is found in a 1924 announcement placed by Samuel Ungerleider & Company in the Times Recorder newspaper in Zanesville, Ohio, naming a new manager:

We beg to announce the opening of our branch office in the Richards Building, at Market Street, Zanesville, Ohio under the management of Mr. R. A. Rowan – where we will have every facility for the prompt execution of orders of Stocks, Bonds, Grain, Cotton, Foreign Exchange, and Commodities, with Private Wire Connections to all principal exchanges, as well as a complete statistical department for the benefit of our clients.

James G. Hall would have had access to a host of stocks, bonds, foreign exchanges, and commodities markets by which to make a fortune for both himself and his employer. Also, the New York City branch was thriving and outgrowing physical space. In 1928, the Wall Street Journal announced that Ungerleider’s New York City office, on Wall Street, had undertaken a major expansion of floor space. Logically, the leasing of additional square footage would confirm the need for more brokers to manage larger volumes of trade:

Ungerleider Enlarges Space: Ungerleider has leased the entire second floor of the 50 Broadway Building, consisting of 11,500 square feet. In addition, the firm has taken a portion of the New Street wing of the floor above.

There was an image of the 1920s broker, certainly cultivated by both the promotion of conspicuous wealth by Wall Street “operators” and the media in the form of newspaper articles, profiling the major investors, their inner circle and the financial fortunes being made and lost. These men would certainly qualify for, in a very real sense, the 1980s Wall Street term, “Masters of the Universe.”

In a 1929 article profile from The Brooklyn Citizen, my grandfather’s brokerage association with Ungerleider is mentioned along with an analogy for his financial quests:

“Though primarily a broker, Mr. Hall is still an ardent flyer, having his own plane which he flies for the sake of sport. He has made several long-distance flights to remote places in the United States and Canada in quest of game. And his personal friends, who value the strong, yet quiet and sincere camaraderie so typical of airmen, are predicting his next achievement in ‘altitude records’ on Wall Street.”

Samuel Ungerleider, with membership to the NYSE, and my grandfather and other well-established brokers, all would operate independently of any government oversight or regulation and accumulate profit with no income tax. Leveraging access to insider trading knowledge, upcoming firm offerings, mergers, acquisitions, and pending stock sales – all within this special “club” – placed James G. Hall at the epicenter of this financial jackpot and entrepreneurial opportunity.

On December 14, 1928, my grandfather would make an enormous personal investment, purchasing a seat on the NYSE. In the pyramiding peak of the market on Wall Street, James G. Hall would pay a record $595,000 for a seat at the table of the most exclusive club in the world of finance. Again, this transaction and my grandfather’s profile would be headline news in the New York Times, the Wall Street Journal, the Chicago Tribune, and other major newspapers across the U.S. Specifically, the Chicago Tribune, on December 15th, 1928 ran a short but sensational headline:

Record Price for Exchange Seat Paid by J. G. Hall – New York, Dec. 14 – J. Goodwin Hall is revealed as the buyer of the New York stock exchange membership for the record price of $595,000. And Louis Haight, a member since 1913, as the seller. The highest price for membership the year Mr. Haight became a member was $53,000.

In a matter of just a few years, James G. Hall had advanced his financial position and business connections on Wall Street to allow for access to a highly small circle of elite investors. In 1928, there were just 825 NYSE seats. The unparalleled advantage for these select seat holders were numerous, including first purchase options for initial stock offerings. From a profit standpoint, relative to the enormous transaction volume of stock on a daily basis, the individual NYSE seat holder, such as my grandfather, would be paid a commission on every stock sold. Therefore, the ability to rapidly make trade transactions – buys and/or sells – directly correlated with the volume of commission an individual or a brokerage would receive.

As stated in a 2005 National Bureau of Economic Research publication, “The Highest Price Ever: The Great NYSE Seat Sale of 1928 and 1929,” an article focused on the subject of NYSE membership history, stating that the volumes were mushrooming during this 1920s’ “Bull Market” period:

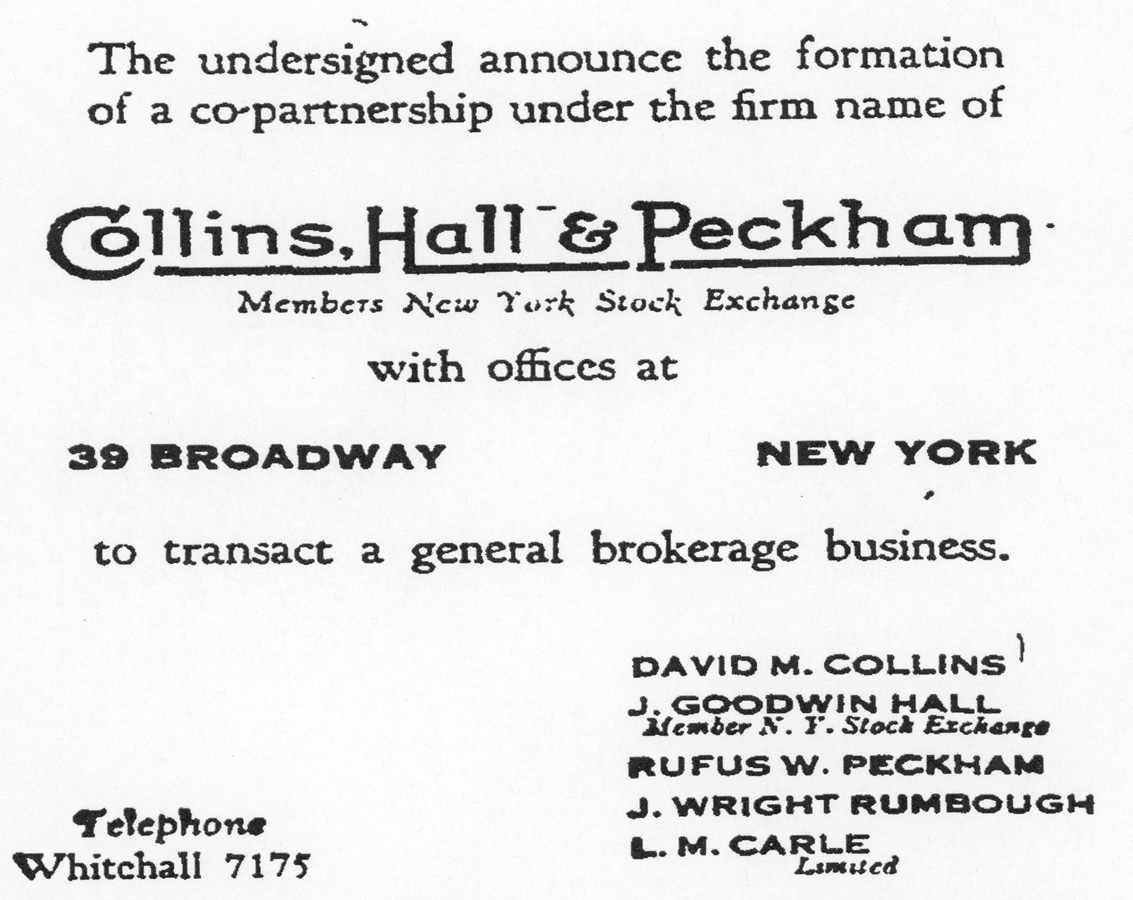

My grandfather would therefore take the next logical step in maximizing the volumes of stock trades he could execute, by establishing and opening a brokerage partnership. On January 23, 1929, the announcement ran in the Wall Street Journal regarding the formation of a co-partnership under the firm name of Collins, Hall & Peckham. The New York Times reported the specific general partners and limited partners, and some personal details:

New Brokerage Firm: Collins, Hall & Peckham to transact General Business on Exchange.

David M. Collins, J. Goodwin Hall, Rufus W. Peckham, all formerly associated with Samuel Ungerleider and Co., and Major J. Wright Rumbaugh, as general partners, and L. M. Carls as a limited partner have formed a co-partnership under the name of Collins, Hall & Peckham to transact a general brokerage business on the New York Stock Exchange, with offices at 39 Broadway. Mr. Hall holds a membership on the Exchange.

Mr. Collins, a son-in-law of L.F. Loree, was in 1926 and 1927 vice president of the Missouri, Kansas & Texas Railroad Company and associated with Ladenburg, Thalmann & Co. A graduate of the United States Naval Academy at Annapolis in 1915, Mr. Collins was in command of a destroyer in the World War and was a White House aide to President Harding for two years. Mr. Hall was decorated by the French Government for bringing down three enemy planes. Mr. Peckham is a grandson of former United States Supreme Court Justice Rufus W. Peckham. Major Rumbaugh, a field artillery officer in the war, is the son-in-law of Gilbert Colgate, a descendant of the founder of the Colgate-Palmolive Company.

Collins, Hall & Peckham: Brokerage Firm history

Collins, Hall & Peckham would locate their office at 39 Broadway, around the corner from the NYSE and at the nucleus of Wall Street activity. The success of the brokerage would be significantly leveraged and dependent on my grandfather’s NYSE seat allowing exclusive trading advantage. Additionally, his partners Collins, Peckham, and limited partners Major J. Wright Rumbaugh, as general manager, and L.M. Carls would all share their financial networks, which combined would have been quite substantial. My grandfather would continue to receive news coverage from the New York Times and other major financial publications as he approached his first day on the trading floor of the NYSE:

“James Goodwin Hall, Former Atlantan, is Made Exchange Member: J Goodwin, World War aviation hero, will go on the floor of the New York Stock Exchange for the first time tomorrow as a member. He will represent the new brokerage concern of Collins, Hall & Peckham, who will open their doors tomorrow at 30 Broadway. He was recently connected to the brokerage firm of Samuel Ungerleider and Company.”

Certainly, this was a profit scale unimaginable for speculators and brokerages, just as long as stock market purchases drove stock prices higher which in turn drove a rising market. Collins, Hall & Peckham would have participated in this historic run-up of the Wall Street stock market. James G. Hall had entered Wall Street as a NYSE member, and brokerage founder, on a timetable of just nine months before the pending “crash” would occur on October 29th, known as “Black Tuesday.”

Without exception, all brokerage houses in 1929 signaled market-wide optimism, leading right up to weeks before the “crash.” In the “Quotables” financial section of a local Brooklyn, New York newspaper, a buoyant confidence is found in my grandfather’s brokerage firm’s newsletter, providing bullish stock advice:

“We are particularly optimistic regarding the copper stocks and believe that higher prices are in prospect, notwithstanding the advances scored in the past few days. Anaconda particularly impresses us as an outstanding attractive trading medium at this time” – C H P.92

Ironically, just months before the “crash,” technology was advancing in posting quotations, and Collins, Hall & Peckham were cited in the Wall Street Journal as the first users of an automatic quotation board:

Several hundred guests yesterday attended the opening of the offices by the new Stock Exchange firm Collins, Hall & Peckham at 39 Broadway, which exhibited for the first time an automatic quotation board, which registers the changing prices on the ticker tape without the aid of “board boys.” The invention known as an automatic brokerage board, was placed in the rooms of the firm on a rental basis and will save labor from four to five “board boys.”

As an indication of Collins, Hall & Peckham’s brokerage success and expansion, an office was opened in Philadelphia, and they afforded to install direct private telephone lines to expedite trade transactions:

“Collins, Hall & Peckham, members of the NYSE, yesterday announced the installation of private telephone wires to Detroit and Cleveland, making the third private brokerage phone to Detroit and the second to Cleveland.”

Much false optimism and examples of “sunny day” forecasts are seen in the financial newspapers leading up to the “Wall Street Crash” in October 1929. Collins, Hall & Peckham are no exception to this trend, as this stock advice statement appears in the Brooklyn Daily Eagle, while offering consolidation advice only:

Collins, Hall & Peckham – The current upswing is likely to carry further but we would not bid after stocks at this time. These strong rallies, in our opinion, afford an opportunity to strengthen trading accounts by reducing the size of the commitments and eliminating issues without unusual promise at this time.

The final days before “the bottom dropping-out” of the market” were filled with now, obvious warnings, and all but ignored by the 1929 Wall Street trader, investor, or man on the street. Margins were leveraged at sometimes 60%, and broker’s loans soared:

“Broker’s Loans Up $192,000,000 TO Peak: Loans to brokers and dealers by New York member banks totaled $6,761,000,000 on Sept. 25, a new peak, the Federal Reserve Board reports.”

October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the NYSE in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-1939). This was the deepest and longest-lasting downturn in the history of the Western industrialized world at that time."

In the days that followed the “crash,” Collins, Hall & Peckham would be quoted heavily in the financial newspapers, with a familiar trending hindsight adopted by many other brokerage firms. A particular New York Times article references my grandfather’s firm, as quoted by Robert Sobel in The Great Bull Market: Wall Street in the 1920s:

“One investment bank said it better than most: “Certain theories of speculation have caught the public fancy in recent years and the liquidation of stocks has vividly illustrated the fallacies present in these theories” – according to a monthly financial review of Collins, Hall & Peckham.”

Simply put, my grandfather’s brokerage went on to point out several fallacies inherent in the investor’s mindset before the collapse of the NYSE and resulting burst of the financial bubble in October of 1929. The first myth was that no substantial “break” – crash – could occur because of the belief that investment trusts would buy stocks on any decline. The second myth was that “margin” accounts were so well protected that the trader “could never be wiped-out.” Lastly, the myth that chasing the rise of stock prices, by purchasing more stock and expecting constant appreciation of stock prices, was sustainable.

Obviously, the odd irony is that James G. Hall’s brokerage, and certainly many other brokerage newsletters, would be attempting to explain the causes of the market crash in terms of the very financial tools and business operations that they had helped develop, employ, and profit from.

Though I cannot research any more detail relating to my grandfather’s brokerage status during this catastrophic financial period on the NYSE, I can only assume there was an enormous impact on my grandfather’s personal and professional enterprise and investments. The most direct indication is that Collins, Hall & Peckham would join the ranks of hundreds of other brokerage firms and cease to exist as a business entity as published in the Wall Street Journal on December 6, 1929:

“New Firm: The firm of Collins, Hall & Peckham, members of the New York Stock Exchange, will dissolve as of December 16 when J.G. Hall and R. W. Peckham will withdraw. The firm will be taken over by the present senior member, David M. Collins, and will continue under the name of D.M. Collins & Co.”

Additionally, James G. Hall would in fact sell his NYSE membership back to the remaining brokerage partner, David M. Collins, on December 27, 1929, for an undisclosed amount.

My grandfather and other fellow brokers would have undoubtably enjoyed a privileged social life during the heyday of the ascending stock market in the mid- to late-1920s. Prior to Black Tuesday, October 29, 1929, this period was referred to in film and literature as “The Roaring 20s.” This lifestyle has certainly been written about extensively and portrayed in movies with varying degrees of balance between myth and reality. One of the most recognizable fictional characters and storylines of this period would be F. Scott Fitzgerald’s 1925 novel The Great Gatsby. Fitzgerald’s legendary and cautionary tale of Jay Gatsby, the millionaire and mansion owner, hosting extravagant parties set in the elite seaside “Breakers” neighborhood of Newport Rhode Island ends in tragedy. In this period piece of a fast paced, conspicuous consumption-oriented lifestyle with profit-driven motives, seeking all personal pleasure and excess, there is a final reckoning.

Several minor headlines about James G. Hall found in national and regional newspapers during this period shed some light on a lifestyle of some notoriety and social status, as well as many adventurous pursuits. The article, “New Member of Exchange – J Goodwin Hall – An Air Hero of War – Had Colorful Youth Here,” has an overall tabloid tone. Further into that particular article, the newspaper over-dramatically states that after World War I and other business enterprises, my grandfather had “a subsequent romantic appearance on Wall Street as one of the most successful of the youthful brokers in the financial district.”

A few other newspaper articles from the late 1920s brokerage period provide some insight, by association, as to the social circles, position, and attention James G. Hall received from the public eye. Most sensational is a newspaper photo from the Daily Gazette (Rockford, Illinois) on February 11, 1928 showing my grandfather in New York City in the boxing ring with baseball legend Babe Ruth, on Ruth’s 34th birthday. Clearly a gossip piece and a promotional story for the entertainment section which photographs both men in a set up pose, throwing coordinated punches at one another. The caption reads, “J.G. Hall, New York banker, is shown boxing with Babe Ruth while Art McGovern, trainer, referees on occasion of the King of Swats’ thirty-fourth birthday.”

Moe conservatively, the New York Times reported on May 29, 1930 of a dinner event for Japanese Ambassador to Brazil, Akira Ariyoshi, and my grandfather was among the invited guests, dining at the Ritz-Carlton in New York City.

Naturally, James G. Hall would also associate socially with other pioneers of aviation, both men and women. At the California Breakfast Club, as reported by the Los Angeles Times on August 9, 1931, my grandfather and other highly notable pilots would attend this hosted event for “famous airplane pilots and aviation officials” including Amelia Earhart. Additional record setting female pilots of the period included Florence Lowe Barnes, Gladys O’Donnell and Mildred Morgan along with racers and record setting solo flight aces Col. Roscoe Turner, Col. Art Goebel and Capt. Roy Ammel.

On the west coast in San Diego, my grandfather was also racing speed boats, a member of the exclusive San Diego Yacht Club, and elected commodore of the San Diego Power Boat association in 1927. As reported in the San Diego Union on December 12, 1926, he participated in the National Speed Boat Regatta, “‘Miss San Diego’ – owner J. Goodwin Hall – San Diego’s only home entrant and a home product being built by A.L. Boyce here. Yesterday’s race dedicated the craft.”

In addition to racing hydro-speed boats in San Diego Bay, James G. Hall was also busy in horse shows back east in Virginia and Long Island, New York. He entered his bay, reddish brown gelding “Golden Eagle” in summer contests in 1926:

“Babylon, New York – Babylon Horse Show: The most keenly contested championship class was that for hunters won by J. Goodwin Hall’s bay gelding Golden Eagle, with the Ladew’s grey gelding, The Ghost, in reserve. Hall and Ladew had been dividing the hunter and jumpers’ prizes with monotonous regularity throughout the two days and when the rivals joined the issue in the championship class, the interest ran high.”

As a self-made man with a significant fortune and many business enterprises, my grandfather would have assumed some Gatsby-like characteristics. Beyond a glimpse of sensational news – the truth is hard to ascertain. As later chapters will reveal, a truer profile emerges of a patriotic, heroic, and decorated veteran. The extravagant lifestyle no doubt associated with this period of his life, as earned by his own financial success, is still yet an early chapter in his life’s adventures, achievements, and accomplishments – which all still lay ahead.